maybefalse/iStock Unreleased via Getty Images

Alibaba (NYSE:BABA) has gone through an excruciating decline in recent years. From peak to trough, Alibaba dropped by over 80% after peaking at around $320 in 2020, and despite its rebound from the lows, its stock remains 70% below its ATH.

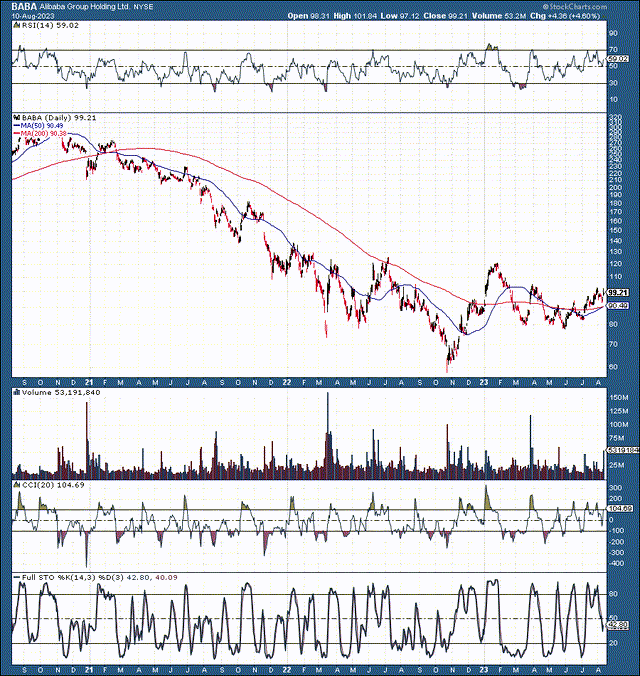

Alibaba 1-Year Chart

BABA (StockCharts.com)

Alibaba's downtrend lasted around two years, and its stock has primarily moved sideways over the last 12-18 months. The persistent stock slide materialized due to several factors, including regulations, fines, an economic slowdown, fears of delisting, and other transitory elements. Now that the uncertainties are fading, we could see Alibaba move much higher in future years.

Moreover, a highly constructive long-term inverse head and shoulders pattern has formed. The breakout level is straight ahead, around $120, and Alibaba could go much higher afterward. Alibaba recently reported a solid, much better-than-expected earnings report, illustrating better-than-anticipated revenue growth, implying Alibaba's revenue growth could re-accelerate in the coming years.

Furthermore, Alibaba's stock is still dirt cheap here, making it one of the most compelling large-cap buys in the market. Alibaba trades at only 10.5 times next year's consensus EPS estimates. However, Alibaba could be trading below a 10 (forward P/E), as it should surpass analysts' consensus figures, providing profitability toward the higher end of the estimate range. Alibaba's improving growth and strengthening profitability should enable its stock to move substantially higher in the years ahead.

The Selloff - Just What Alibaba Needed

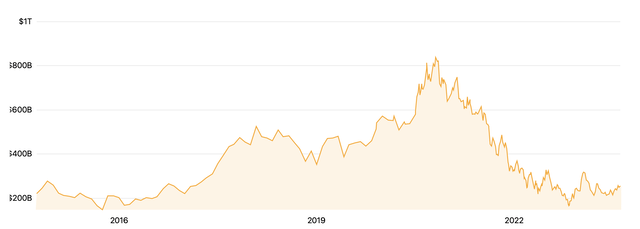

Alibaba's decline has been one of history's most significant wealth destructions. The company's market cap peaked at about $850 billion in 2020, crashing to approximately $165 billion during the selloff. Now Alibaba is around $250 billion in market cap, roughly around its IPO valuation nearly a decade ago.

Alibaba's Market Cap: 2014-2023

Market cap Alibaba (Companies ranked by Market Cap - CompaniesMarketCap.com)

However, the selloff may be a constructive factor as we move forward. Alibaba's poor performance has sparked a reorganization that is "unleashing new energy across the company's businesses," said company CEO Daniel Zhang. The downturn has lit a fire beneath the company's management, catalyzing innovation and revitalizing the organization, enabling it to focus on shareholder value and unlocking long-term growth.

Alibaba: The Outperformance Likely to Continue

For the quarter ending in June, Alibaba reported:

- Non-GAAP EPADS of $2.40, crushing consensus estimates by 39 cents.

- This represents a 19.4% earnings beat for Alibaba.

- Moreover, the company's EPS surged by 56% YoY.

- Alibaba's revenue was $32.29B, a $1.08B beat (14% increase YoY).

- Profitability surged, with income from operations increasing by 70% YoY.

- The cost of revenue decreased from 62% to 61% of revenues.

- R&D decreased from 5% to 4% of revenues.

The Takeaway

Alibaba's reorganization is reflecting favorably on its business practices. Growth is improving better than anticipated, the company is becoming more efficient, and its profitability is expanding more robustly than expected. Moreover, better-than-expected earnings results should continue, leading to multiple expansion and a much higher stock price in future years.

Yes, Alibaba Is Still Dirt Cheap

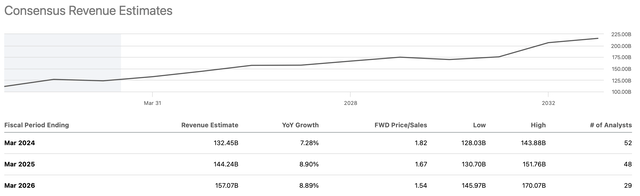

Revenue (SeekingAlpha.com )

Alibaba's stock trades at less than two times sales, with the consensus estimates pointing to around 9% in revenue growth. However, due to the better-than-expected results and improving growth figures, Alibaba can provide revenue growth in the 10-15% range as we advance. Therefore, we could see significant revenue growth outperformance, with figures around the higher end of the estimate range in the coming years.

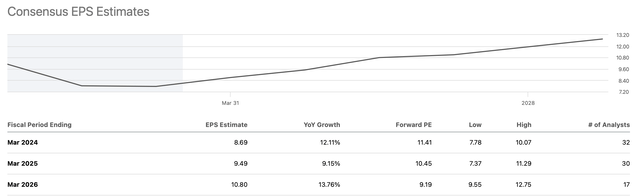

EPS Growth To Increase

EPS estimates (SeekingAlpha.com )

Consensus estimates project EPS of about $8.70 this year and $9.50 next year (fiscal 2025). However, due to Alibaba's effective cost-cutting measures, improving growth prospects, and increasing profitability, we could see EPS of $9-$10 this year and $10.50-$11 in fiscal 2025. Therefore, if we use a median higher-end estimate of about $9.50 this year and $10.75 next, we arrive at a forward P/E ratio of only about 8.9 for fiscal 2025.

Also, Alibaba has a strong record for beating earnings estimates, and that trend should continue as we advance. Additionally, due to the lowballed EPS estimates, Alibaba's beat rate could accelerate in future quarters.

EPS actual vs.estimates (SeekinaAlpha.com )

Alibaba has missed EPS estimates in just two of its last twenty quarters. Also, if we look at the company's previous four quarterly EPS results vs. estimates, we see an annual outperformance rate of about 16%. Now, consensus estimates are for $8.61 for Alibaba's next four quarters. Applying a similar 16% beat rate should enable the actual EPS to be about $10, roughly in line with our higher-end estimates.

Furthermore, Alibaba delivered $8.53 in EPS in its last four quarters. Due to the improving macroeconomic environment, cost cutting, expanding growth, and robust profitability potential, it makes sense to see approximately 15-20% YoY growth. Applying a 15-20% growth rate to TTM EPS gives us $9.80-$10.23, also putting the EPS in the higher-end of the estimate range in the next few years.

Where Alibaba's Stock Could Be in Future Years:

| Year (fiscal) | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $136 | $151 | $173 | $198 | $222 | $246 | $271 |

| Revenue growth | 10% | 11% | 15% | 14% | 12% | 11% | 10% |

| EPS | $9.5 | $10.7 | $12.6 | $15 | $17.7 | $20.4 | $23.2 |

| EPS growth | 23% | 13% | 18% | 19% | 18% | 15% | 14% |

| Forward P/E | 8.9 | 12 | 17 | 21 | 20 | 18 | 17 |

| Price | $95 | $151 | $255 | $372 | $408 | $420 | $450 |

Source: The Financial Prophet

Risks Exist For Alibaba

Despite my bullish outlook, Alibaba is an increased-risk investment for several reasons. First and most apparent, Alibaba is a Chinese company, and political tensions continue to weigh on its stock. Additionally, there is an increased risk of Chinese government regulation. Furthermore, there are lingering delisting concerns if Alibaba or the Chinese government fails to comply with U.S. auditors. There's also the Chinese slowdown, and there is a risk that Alibaba's revenues will expand slower than planned.

Furthermore, Alibaba's profitability could fall short of expectations, leading to renewed skepticism about its stock. Finally, sentiment could remain depressed, keeping a lid on Alibaba's multiple and stock price in the coming years. Investors should consider these and other risks carefully before committing capital to an investment in Alibaba's stock.

"still" - Google News

August 12, 2023 at 02:24AM

https://ift.tt/4kCB0bl

Yes, Alibaba Is Still Dirt Cheap (NYSE:BABA) - Seeking Alpha

"still" - Google News

https://ift.tt/lUzYk0X

https://ift.tt/ItPnvpN

Bagikan Berita Ini

0 Response to "Yes, Alibaba Is Still Dirt Cheap (NYSE:BABA) - Seeking Alpha"

Post a Comment