Scott Olson

Introduction

As a dividend growth investor, I focus on discovering new chances for investments in assets that generate income. Whenever I come across appealing options, I frequently bolster my current holdings. A year ago, I analyzed the shares of Tyson Foods (NYSE:TSN) and rated them a BUY. Obviously, I was wrong, as in the year that passed, the share price is down 34%, while the S&P 500 is up 16%. I will revisit the company in this article to see if my investment thesis has changed.

The consumer staples sector is an interesting one during times of uncertainty. Investors prefer safer bets and stocks that can serve as a haven. Tyson Foods is a company that, despite being part of the sector and selling food, has seen its stock price plummet over the last twelve months. The inflationary pressures have crushed the company's EPS despite the growing sales, and as the inflation is being tamed by the Federal Reserve, the company may be a bargain.

My methodology for analyzing Tyson Foods is the one I use to analyze dividend growth stocks. I am using the same method to make it easier for my readers to compare researched companies across different sectors. I will examine four main categories: fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it's a good investment.

To have a better familiarity with Tyson Foods, Seeking Alpha's company overview states that:

Tyson Foods operates as a food company worldwide. It operates through four segments: Beef, Pork, Chicken, and Prepared Foods. The company processes live-fed cattle and live market hogs fabricates dressed beef and pork carcasses into primal and sub-primal meat cuts, as well as case-ready beef and pork, and fully cooked meats, raises and processes chickens into fresh, frozen, and value-added chicken products, including breaded chicken strips, nuggets, patties, and other ready-to-fix or fully cooked chicken parts, and supplies poultry breeding stock. It also manufactures and markets frozen and refrigerated food products, including ready-to-eat sandwiches, flame-grilled hamburgers, Philly steaks, pepperoni, bacon, breakfast sausage, turkey, lunchmeat, hot dogs, flour and corn tortilla products, appetizers, snacks, prepared meals, ethnic foods, side dishes, meat dishes, breadsticks, and processed meats.

Fundamentals

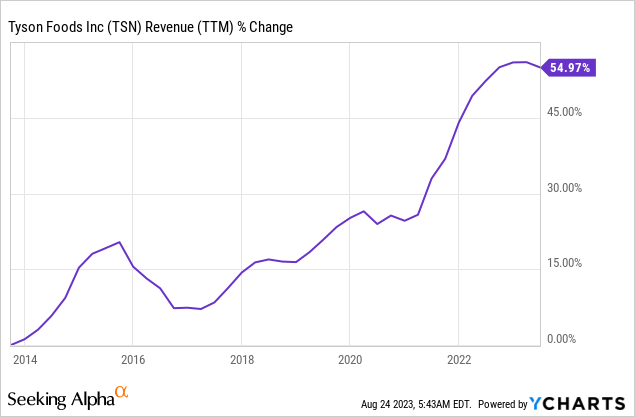

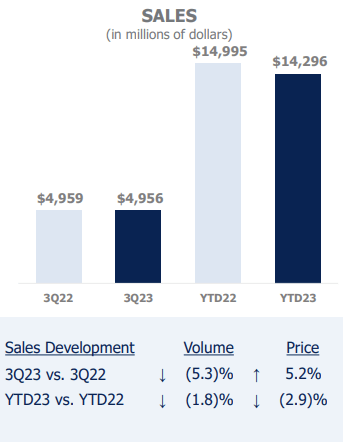

The revenues of Tyson Foods have increased by 55% over the last decade. Sales, as seen in the graph, grow relatively steadily, and there are three main catalysts for sales growth: higher prices, higher volumes of meat, and acquisitions as the company acquires either retail brands or additional facilities to increase its scale and scope. In the future, as seen on Seeking Alpha, the analyst consensus expects Tyson Foods to keep growing sales at an annual rate of ~2% in the medium term.

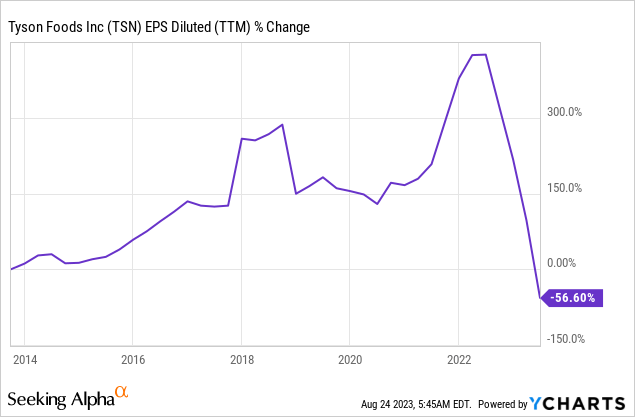

While the sales increased, the EPS (earnings per share) has decreased by more than 50% over the last decade. The EPS declined by over 80% this year compared to the previous year, as inflation has pressured the company's margins. Higher costs lowered demand and shifted it towards less profitable products. That created a perfect storm that has hurt the EPS. In the future, as seen on Seeking Alpha, the analyst consensus expects Tyson Foods to keep growing EPS at a high double-digit growth rate following the harsh 2023 as the company recovers its EPS in the medium term.

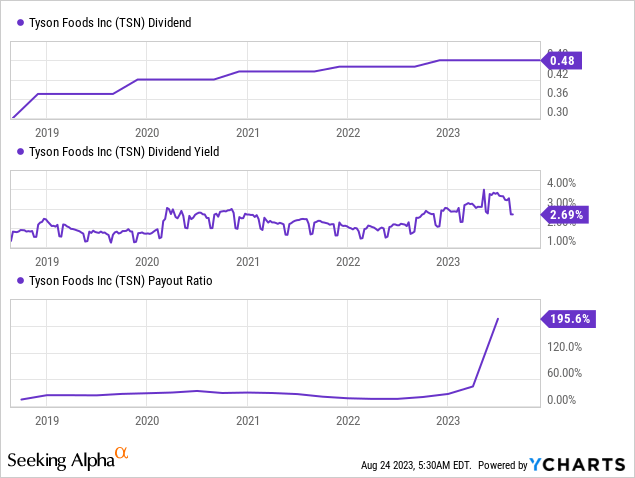

Tyson Foods has been increasing the dividend for the last ten years and has not decreased it for thirty years. Therefore, it corresponds with the management position that the dividend is a priority and part of the base capital allocation plan. The current dividend of $0.48 per share equals an annualized yield of 3.6%. While the payout ratio is high due to the decrease in the company's margins, it will stabilize below 100% as it recovers its margins. Therefore, as the non-GAAP payout ratio is expected to be 65%, I am not concerned about the dividend's stability.

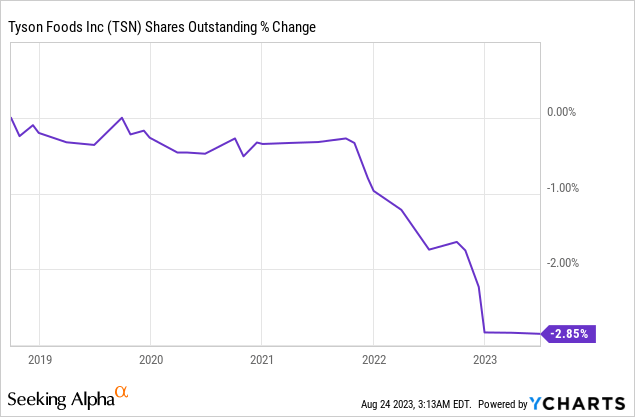

In addition to dividends, companies, including Tyson Foods, return capital to shareholders via buybacks. These share repurchase programs support EPS growth by lowering the number of shares. Over the last five years, the company has decreased the number of shares by almost 3%. Buybacks are highly efficient when the share price is attractive, and in its latest quarterly report, the management emphasized that buybacks are an integral part of its capital allocation plan.

Valuation

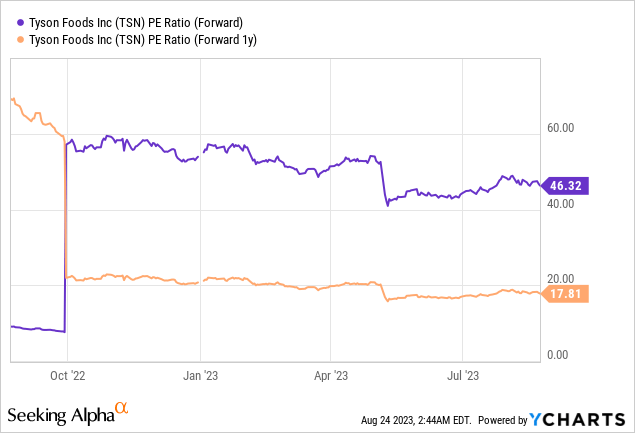

The P/E (price to earnings) ratio of Tyson Foods stands at 46.32 when looking at the P/E ratio based on the EPS estimates for the current year. This is a high valuation for a consumer staples company. However, 2023 is not a typical year as inflationary pressures crushed the EPS. When looking at the estimates for 2024, the P/E ratio is 18, with the forecast for continuous EPS growth intact. Therefore, the current price is a good entry point if the company manages to execute and gradually recover its margins.

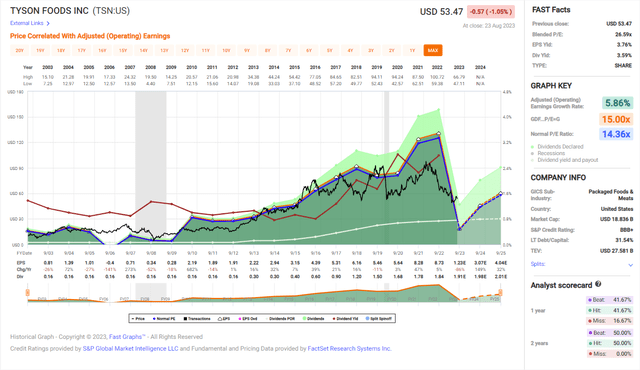

The graph below from Fast Graphs shows a good reason for the poor stock performance. However, it also indicates that the current price is a decent entry point if you believe a recovery is in place. The company's average P/E ratio over the last twenty years was 14.36. That equates to an EPS of $3.7 based on today's share price. The company is expected to surpass that figure in two years and continue to grow as it lowers its debt, automates its facilities, and improves its margins.

Fast Graphs

Opportunities

The company's scale is one of its most prominent growth opportunities. The entire industry is struggling due to the higher cost. As the leading company, Tyson Foods can leverage its economics of scale and become a more competitive player. It will leverage its supply chain, delivery capabilities, and volumes to negotiate better deals and lower marginal costs.

One of the critical opportunities that Tyson Foods has to leverage its scale is investments in automation. Despite the lower margins, the company has increased its capex. YTD, the capex is 23% higher than in the same period last year. That investment is funneled for increased capacity and, more importantly, modernizing their facilities by increasing the automation of processes.

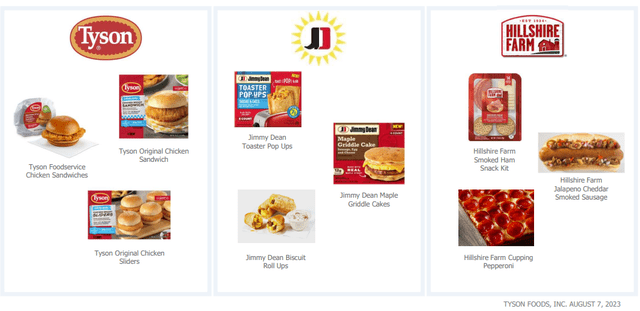

Another growth opportunity the company has is its Prepared Foods segment. The segment allows the company to grow vertically on the value chain. Instead of offering the primary product, it provides the packed goods using its brands. This is a profitable segment even during that inflationary period. Despite the inflation, the segment's operating margin has increased from 8.9% to 10.1% in the past twelve months. Therefore, while sales were up 2.3%, the segment's operating profit was up 16%.

Tyson Foods

Risks

The change in consumers' tastes may take time to recover and shift even further. Inflation has caused an increase in the price of food. Consumers went from beef to other cheaper proteins, and beef was Tyson's most lucrative business (14% operating margin compared to 5% for pork and chicken). It may take some time before demand for beef recovers, especially at these higher prices. Moreover, we still see an increased demand for plant-based proteins, and while Tyson does offer it and invests in cultured meat, it is still far from its core business.

Tyson Foods beef sales:

Tyson Foods

While the company manages to stabilize its margins, inflation is still here. We may still see additional inflationary pressures on consumers that may limit the growth of sales even more. As proteins become more expensive due to inflation, it may also hinder top-line sales. Sales have been growing despite the challenges, and if sales start to decrease when the company invests heavily and costs increase, it may be an even more significant challenge.

Another challenge Tyson Foods is dealing with is the current size of the beef herd. The US beef cow herd has fallen to a 52-year low. The small size of herds means that there is a low supply, and therefore, the price of beef is likely to stay elevated. Growing beef for food takes several years. Consequently, it may take several years to see a significant decrease in beef prices. With lower prices, the demand for Tyson's most lucrative product will struggle to grow, in my view.

Conclusions

To conclude, Tyson Foods is a blue chip company and one of the leading food and beverage industry companies. The company has a history of growing sales and income and rewarding shareholders with buybacks and dividends. That growth over decades has turned Tyson Foods into the largest meat company in the United States. The company can leverage its size and investments in new facilities to increase its market share.

The company is dealing with a highly challenging business environment due to high inflation. While the company is stabilizing its margins, the challenges are still intact, mainly regarding inflationary pressure and the price of beef. I believe Tyson Foods has dealt with similar challenges and will prevail again. Therefore, the current valuation and price offer an excellent entry point, making the company a BUY.

"still" - Google News

August 25, 2023 at 02:39AM

https://ift.tt/PaGdL7E

Tyson Foods Is Still A Buy (NYSE:TSN) - Seeking Alpha

"still" - Google News

https://ift.tt/ImMPVWK

https://ift.tt/hH0LS1D

Bagikan Berita Ini

0 Response to "Tyson Foods Is Still A Buy (NYSE:TSN) - Seeking Alpha"

Post a Comment