The Federal Reserve acknowledged it was caught off guard by soaring inflation this year and that it was less certain about how fast the price increases would unwind, internal notes from its last big meeting show.

The Fed’s chief decision-making body, known as the Federal Open Market Committee, stuck its forecast that the annual rate of inflation would fall back toward 2% by next year. Prices are rising at almost double that rate right now.

Read: Fed dived into taper debate at June meeting, but nothing seems imminent

Yet at the June 14-15 meeting, senior central bankers admitted they underestimated the rise in inflation this year.

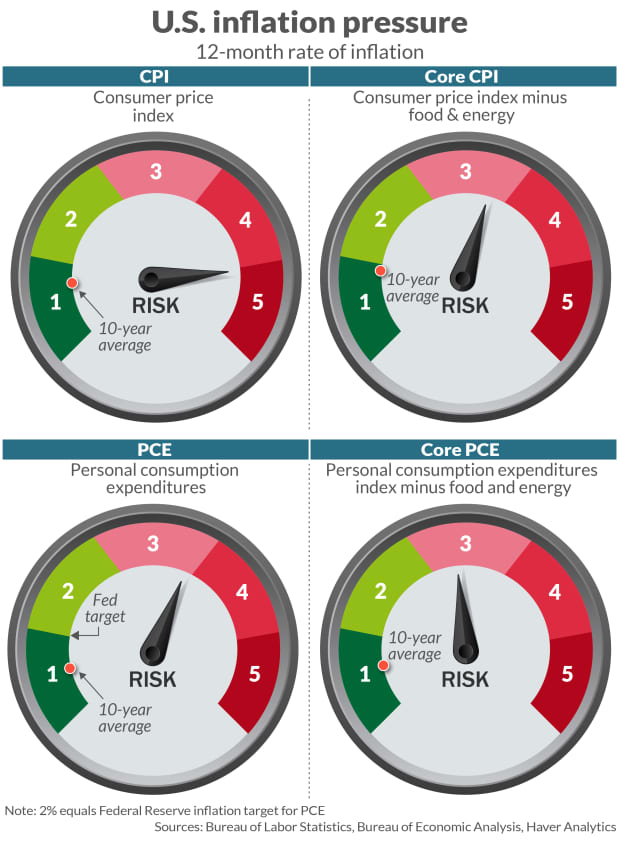

Consumer prices shot up 3.9% in the 12 months ended in May, reflecting the biggest gain since 2008, based on the Fed’s preferred inflation gauge known as the PCE. The rate of inflation is nearly twice as high as the Fed’s 2% goal.

Read: Consumer prices surge again as inflation gauge hits highest rate since 2008

A separate measure of inflation that strips out food and energy also climbed to the highest level since 1992.

“Participants remarked that the actual rise in inflation was larger than anticipated,” according to the minutes of the FOMC meeting made public on Wednesday.

Read: Job openings hit record 9.2 million, but workers aren’t easy to find

Also: There’s plenty of jobs, but not enough people to fill them. How come?

Top officials blamed the rise in inflation on higher oil prices and a bigger-than-expected surge in the economy this spring.

The crush of demand has created major shortages of key supplies such as computer chips, a problem compounded by the inability of companies to fill a record number of open jobs. They have had to raise wages or in some cases cut back on production because of these bottlenecks, the Fed noted.

“[A] substantial majority of participants judged that the risks to their inflation projections were tilted to the upside because of concerns that supply disruptions and labor shortages might linger for longer and might have larger or more persistent effects on prices and wages than they currently assumed,” the notes said.

Read: Fewer and fewer people are working full-time from home

A few FOMC members seemed especially worried, suggesting the bout of higher inflation would persist into next year and perhaps beyond.

Most top Fed officials still insisted inflation would taper off by next year, though.

After the June meeting, the Fed jacked up its median estimate of inflation in 2021 to 3.4% from as low as 1.8% just six months earlier. Yet the FOMC still predicts the rate of inflation will slow to 2.1% in 2022.

Chairman Jerome Powell and other Fed leaders insist prices will ease as the economy returns to normal, most people go back to work and widespread shortages of labor and supplies fade away. They point out that inflation has been low for years before the pandemic erupted in the U.S. in early 2020.

"still" - Google News

July 08, 2021 at 02:01AM

https://ift.tt/3hogsZT

Fed admits inflation rose much higher than expected, but it still insists price increases are temporary - MarketWatch

"still" - Google News

https://ift.tt/35pEmfO

https://ift.tt/2YsogAP

Bagikan Berita Ini

0 Response to "Fed admits inflation rose much higher than expected, but it still insists price increases are temporary - MarketWatch"

Post a Comment